英国兰留学生dissertation:论述英国和全球的房地产及物业市场

Chapter the UK and global real estate and property market

英国和全球的房地产及物业市场

Introduction

介绍

This chapter will discuss the property market of UK and global market, examininf both the residential and commercial sectors.

本章将讨论英国和全球市场的房地产市场,同时检查住宅和商业部门。

Outline of current UK property market

目前英国房地产市场概况

The UK property market boomed for the seven years up to 2008 and in some areas property trebled in value over that period. The increase in property prices mainly due to the sustained economic growth, low interest rates, the growth in property investment(especially the oversea investment), and planning restrictions on the supply of new housing.

英国房地产市场繁荣七年至2008年,在此期间在某些方面属性值三倍。楼价上升主要是由于经济持续增长,低利率,房地产投资的增长(尤其是海外投资),和新的住房供应的规划限制。

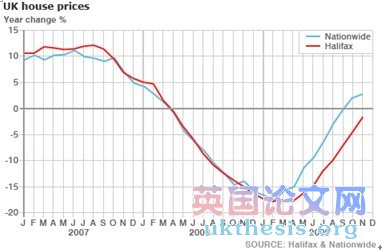

UK property market analysts have revised previously negative assessments of the market, with most subsequently predicting continued modest growth in prices in the mid-term24. However, around September 2007, house prices began to fall consistently, arguably contributing to the negative UK economic growth of the 3rd Quarter 2008.

The paucity of finance available to homebuyers by the self-regulation of the banks following the collapse of the financial system in 2007 continues to contribute to a very much diminished demand for housing in the UK with sales volumes around half of the pre-crash level. With many sellers reluctant to drop their price, there is a chronic over-supply of housing on the market at prices in excess of demand (as of September 2009),34 leading to the average time on the market for residential property to be over 12 months (well above the long term trend). This situation has arisen partly because of the deferred repayment windows created by the government forcing the courts to delay possession orders. As the regulatory framework of the banks is in concordance with Basel II,35 then the demand for UK residential property is likely to remain very subdued in comparison to pre credit-crunch lending for many years to come.

As the forced sellers in the market increase when the repayment deferrals cease, in combination with other forced sellers (death and divorce), many economists predict that the worst of the crash in UK residential property is yet to be realized. This is in keeping with other major economies that experienced rapid house price growth over the last decade; they have seen larger scale falls in prices that have yet to materialize in the UK, as of September 2009.

UK House Prices 2007-09 Sources: BBC – UK House Prices

UK House Prices 2007-09 Sources: BBC – UK House Prices

The prospective of UK property market#p#分页标题#e#

英国房地产市场的前景

Experts estimate that nearly all of the 1 million buy-to-let investors and 250,000 second home owners will be liable for CGT at the new higher rate of 28 per cent, even if they are basic rate taxpayers.

据专家估计,几乎所有的1万元购买到让投资者和250,000的第二个家业主将负责CGT,即使他们在新率较高,28%的基本税率纳税人。

http://www.ukthesis.org/dissertation_sample/

In the new budget, George Osborne announced that CGT (Capital Gain Tax) would stay at 18 per cent for basic rate taxpayers and increase to 28 per cent for higher-rate taxpayers.37 I believed UK property industry will be conflicted hard due to this. In the current world property market, there are two type people will purchase the house. One is own-live buyer, another is investor. As we all know, the transaction sum decide how prosperous market will be. The increase of CGT will strike the confidence of investors and blow the property market which has subtle recovery sign.

Frank Nash, partner at Blick Rothenberg, said: "They may well be basic rate taxpayers, but any gains they make on selling an asset is treated by the taxman as if it were income. This could well force them into a higher-rate tax bracket.

"With shares and antiques, that's fine because you can sell a little bit at a time and make sure you don't go into the higher rate. But with property there's nothing you can do about it. You have to sell all of the property at once.37

This quotation shows the reason why the CGT will affect UK property market, because it will compel property owners raise the property price to offset the high tax or reluctant to sale their property until the renaissance. Obviously, whatever the reaction adopted by landlords, both will decrease the transaction volume and frozen the market further. Martin Ellis, economist at the Halifax, said:”It depends on the economic recovery, which currently is sluggish, i’m looking for an improvement in the number of transactions, but it still doesn/t seem like a normal sort of market”.