英国某学院讲稿:对ABF305投资管理的分析及解释

ABF305 Investment Management

Lecture 1

投资管理

演讲1

What would be necessary for successful investment management?

对成功的投资管理有哪些必需?

Knowledge of the investment choices.

Ability to evaluate the investment choices.

Evaluation of risk.

Theory underlying investment management.

Personal viewpoint.

And so on…..

What are our investment choices?

我们的投资选择是什么

Equities.

Fixed income securities, e.g. bonds.

What do we mean by a fixed income security?

How do we value a bond?

我们如何评估债券的价值?

A bond is valued on the basis of its cash flows, namely the coupon payments plus the face value of the bond.

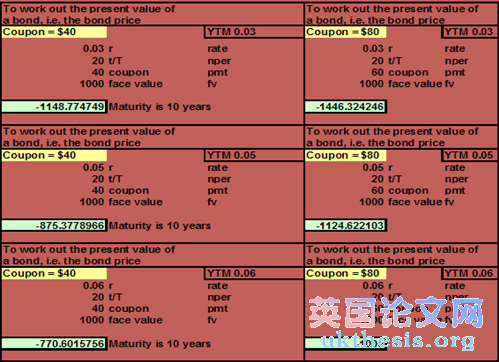

We can demonstrate this with an example: Bond details: Maturity 10 years, coupon rate 8%, coupon payment $40 paid semi-annually, bond face value $1000. The annual market interest rate is 6%.

What should the bond price be?

债券价格是什么样的?

Using a financial calculator.

Using the following formula,

Annuity plus present value tables.

Using the actual cash flows.

How would our bond price change

If we……..

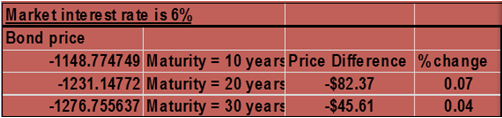

Changed the market interest rate from 6% to 10%.

Changed the maturity from 10 years to 20 years.

Changed the coupon from $40 to $80.

We would observe…..

Malkiel’s (1962) bond-price theorem.

马尔基尔(1962年)的债券价格定理。

The five theorems are:

五个定理是:

1. Bond prices and yields are inversely related: as yields increase, bond prices fall; as yields fall, bond prices rise.

2. An increase in a bond’s yield to maturity results in a small price change than a decreasing yield of equal magnitude.

3. Prices of long-term bonds tend to be more sensitive to interest rate changes than prices of short-term bonds.

4. The sensitivity of bond prices to changes in yields increases at a decreasing rate as maturity increases. In other words, interest rate risk is less than proportional to bond maturity.

5. Interest rate risk is inversely related to the bond’s coupon rate. Prices of low-coupon bonds are more sensitive to changes in interest rates than prices of high-coupon bonds.#p#分页标题#e#

Why do we care about this?

Malkiel’s theorem underlies duration which is the basis for bond hedging.

For the moment it is important that you have understood the fundamentals of how to price a bond, and what are the factors which affect the bond price which can be translated roughly into Malkiel’s five theorem for the bond price.

End of lecture for today

Please remember to put the piece of paper with your student name and email address in the ABF305 Investment Management box as you leave today!