英国纽卡斯尔大学(Newcastle University):中国老人退休现实和问题

Retirement reality and problems

退休现实和问题

2.1 Three elderly support approaches

三个养老方法

In China, people normally have three ways to provide old age. First is state pension income. Second is staying with family. Third is living by own savings.

在中国,人们通常有三种方式来提供老年。首先是国家的养老金收入。二是与家人住。三是自己的积蓄生活。

The present generation of people over age 60th are all born before 1949, the founding of People’s Republic of China. They are normally poor and still have the traditional concept of pension, and be together with their children is the best choice. Some of these elderly are receiving pensions from government at the same time. Thus the majority of present old generation is actually having a not bad old age. Elderly who choose the third type are generally not very old and also have good health condition. Once they get even older, they cannot live alone anymore. In other words, the effective pensions are only first two types.

现在这一代60岁以上的人都出生在1949年以前,中国人民共和国成立。他们通常是贫穷,还有传统的养老观念,与子女一起是最好的选择。一些老人同时还从政府领取养老金。因此,目前老一代的大多数实际上是一个不坏的老年龄。谁选择了第三种类型的老人一般不是很老,还具备良好的健康状况。一旦他们变得更老了,他们不再独自生活。换句话说,有效的养老金只有前两种类型。

Elderly who living with their children could have a better care on both material and moral, but this status quo is not sustainable. There are two reasons.

与子女同住的老人在物质和精神上得到更好的照顾,但这种现状是不可持续的。这里有两个原因。

First is traditional concept change of old age life. On the one hand, majority of the present young people are willing not to live with their children after retirement. On the other hand, they also do not want to over-rely on their children financially due to the baptism in the modern values. These people will have more consideration on how to establish its own pension plan and increase savings. In another words, they will be more biased with the first or third way of pensions.

首先是老年生活的传统观念的变化。一方面,大部分当下年轻人愿意退休后不与子女同住。另一方面,他们也并不希望过度依赖财政对子女由于在现代价值观的洗礼。这些人将有更多的考虑如何建立自己的退休金计划及增加储蓄。换句话说,他们会更偏向第一或第三条道路的养老金。

http://ukthesis.org/dissertation_sample

Second reason is much more important, which is aging population. Thirty-five years ago, the proportion of children population and elderly population was 6:1. However, after thirty-five years, this proportion will be inverted (Richard, 2004). The harsh winter of aging population is coming, and lead to the future of family structure will be like an inverted pyramid. When elderly people more than children, the informal family support network will be impossible to constantly maintain. Therefore, picture of the future left us only one choice, which is state pension insurance.#p#分页标题#e#

第二个原因是更重要的,这是人口老龄化。三十五年以前,儿童人口与老年人口的比例为6:1。然而,后35年,这一比例将倒置(理查德,2004年)。人口老龄化的严酷的冬天就要来了,导致家庭结构的未来会像一个倒置的金字塔。当老人儿童多,非正式的家庭支持网络将不可能始终保持。因此,未来之窗留给我们的只有一个选择,这是国家养老保险。

2.2 Aging population, low average income and poor pension coverage

人口老龄化、低平均收入和贫乏的领取养恤金

Aging population is a global issue, but more serious in China.

人口老龄化是一个全球性的问题,但在中国更为严重。

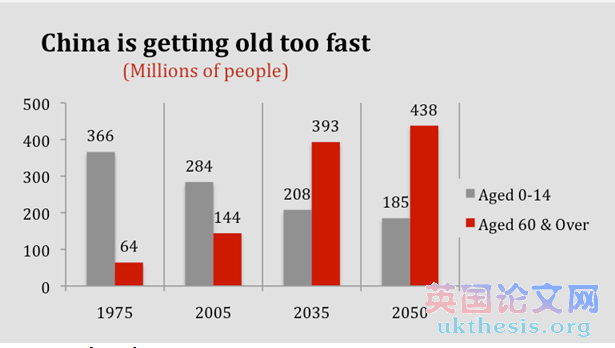

Figure 2 – Demographic forecasting

图2 - 人口预测

Source: UN (2007)

China gets old in one generation, while European countries used almost one hundred years. China’s labour force population will be reduced by 18%-35% around 2050. The “one-child” policy has controlled the population growth speed, but also controlled the birth rate. Plus longevity factor, China will become a white-haired country in 35 years. Most aging countries in the world were getting rich before getting old. If China cannot develop quicker than aging, after 35 years, China will face a very harsh situation, even a big social unrest.

中国一代人变老,欧洲国家将近用了一百年。中国的劳动力人口将减少18%-35%,到2050年左右。 “一胎化”政策,控制人口增长速度,但也控制人口出生率。加上长寿的因素,35年中国将成为一个白发苍苍的国家。在世界上多数老龄化国家致富变老之前。如果中国不能比老龄更快的发展,35年后,中国将面临一个非常严峻形势,即使是大的社会动荡。

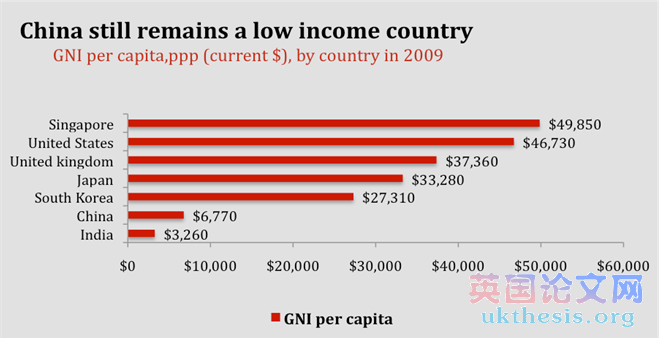

During the 30 years after Economic Opening, the average Gross Domestic Product (GDP) growth rate was 9.8 per cent in China, and 10.6 per cent in the past 5 years. Despite this long-term rapid economic growth, but up to now, it still cannot make up the negative effects of demographic explosion. In 2009, the Gross National Income (GNI) per capita in China was 6,770 dollars, while UK had 37,360 dollars and Singapore had 49,850 dollars. It was 7 times distance, which represent China is still a low-income country.

Figure 3 – Gross national income per capita in different countries

图3 - 在不同的国家,人均国民总收入

Source: World Bank (2010)

Until 2010, China’s Gini index has exceeded 0.5, which means a big gap between rich and poor. In other words, the existing GNI per capita is pulled in some by rich people, and majority of average Chinese should have lower income. However, the present state pension system has not yet considered about wealth gap. It is really not good for social harmony.#p#分页标题#e#

直到2010年,中国的基尼系数已经超过了0.5,这意味着一个大的富国和穷国之间的差距。换句话说,现有的人均国民总收入被拉在一些有钱的人,和大多数普通中国人应该有较低的收入。然而,目前国家养老金制度尚未考虑对贫富差距。这实在是不利于社会和谐。

Since the economic reform from 80years, China has started a rapid urbanization construction. Large number of labour force into the first-tier cities, but construction of rural areas did not keep up with the same period, resulting in a huge income page between urban and rural areas. And because most of young labour force into urban from rural areas, the aging population is more serious in rural areas.

从80年的经济改革以来,中国已经开始了快速的城市化建设。与同期劳动力数量大到一线城市,但农村建设没有跟上,导致在城市和农村地区之间巨大的收入页面。而且,由于大多数青壮年劳动力从农村进入城市,人口老龄化是在农村地区更为严重。

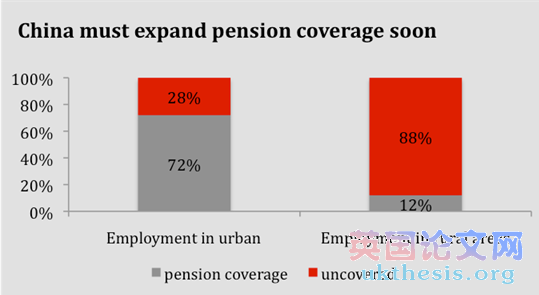

Figure 4: Large number of uncovered

图4: 大量揭露

Source: China Statistical Yearbook 2010

The income difference between urban and rural also results in two lines of China’s pension system. By 2008, pension coverage in urban was 72 per cent, while only 12 per cent in rural areas. However urban labour force accounted for only 39 per cent of national labour force, and rural labour force accounted for 61 per cent. That is the whole pension coverage rate is only 35.5 per cent in China. There were 499 million working people who still do not have pension insurance at all.

城市和农村之间的收入差异也导致两行中国的养老保险制度。到2008年,在城市的养老保险覆盖率为72%,而只有12%在农村地区。然而,城市的劳动力占全国劳动力的39%,占农村劳动力的61%。这是整个养老金的覆盖率在中国只有35.5%。有4.99亿人还没有养老保险。