英国杜伦大学留学生dissertation高分范文

11-07, 2014

概要

本报告主要通过分析“米歇尔和管家服务”内在环境和外在环境,强调它的战略选择分析。为了更清楚地分析并且描述这些内外在环境,本文运用了许多的测量工具。首先本报告探讨了“米歇尔和管家服务”所在的外在环境,它被分成两个部分,也就是宏观环境和微观环境。针对宏观环境我们运用大环境分析,因为大环境分析包含了所有影响“米歇尔和管家服务”的因素,而这些因素“米歇尔和管家服务”都无法控制。而分析它的微观环境我们采用了波特五力模型,因为它强调了所有对机构有直接作用的因素。

在内在环境分析之后,本报告探讨了内部的物流业务.对“米歇尔和管家服务”的内在分析得出了许多业务方面的信息。例如它的资源和性能、竞争性优势、核心能力和它在生命周期上的位置。这些相异的方面会帮助我们分辨“米歇尔和管家服务”能选择的战略是哪些。

在此之外本报告会使用三种财务报告来分析“米歇尔和管家服务”的财务,包括资金流、资产负债表和5年期间的损益表。通过分析这些方面我们可以更好地回顾它的销售趋势和盈利趋势。接下来我们还使用了矩阵分析和随机前沿分析模型来确定它的成长领域,此外自我诊断分析还被用来完善矩阵分析模型的运行。

本报告主要通过分析“米歇尔和管家服务”内在环境和外在环境,强调它的战略选择分析。为了更清楚地分析并且描述这些内外在环境,本文运用了许多的测量工具。首先本报告探讨了“米歇尔和管家服务”所在的外在环境,它被分成两个部分,也就是宏观环境和微观环境。针对宏观环境我们运用大环境分析,因为大环境分析包含了所有影响“米歇尔和管家服务”的因素,而这些因素“米歇尔和管家服务”都无法控制。而分析它的微观环境我们采用了波特五力模型,因为它强调了所有对机构有直接作用的因素。

在内在环境分析之后,本报告探讨了内部的物流业务.对“米歇尔和管家服务”的内在分析得出了许多业务方面的信息。例如它的资源和性能、竞争性优势、核心能力和它在生命周期上的位置。这些相异的方面会帮助我们分辨“米歇尔和管家服务”能选择的战略是哪些。

在此之外本报告会使用三种财务报告来分析“米歇尔和管家服务”的财务,包括资金流、资产负债表和5年期间的损益表。通过分析这些方面我们可以更好地回顾它的销售趋势和盈利趋势。接下来我们还使用了矩阵分析和随机前沿分析模型来确定它的成长领域,此外自我诊断分析还被用来完善矩阵分析模型的运行。

Executive Summary

This report is aimed at highlighting Mitchells and Butlers strategic choices through the analysis of its internal and external environment. A number of measurement tools were used in order to express this. The report firstly looks into the external environment in which the organisation is involved with. The external analysis was split into two different sections: The macro environment and the microenvironment. A PESTLE analysis was used for the macro environment as this captures all the factors that affect Mitchells and Butlers, of which none of them they can control. To analyse the microenvironment Porter's five forces model was used as this highlights all the factors that can have a direct effect on an organisation.

Following the Internal Analysis the report then looks at the internal logistics of the business. Looking internally into Mitchells and Butler identified many aspects of the business such as its resources and capabilities, competitive advantage, core competencies and the stage the company is at with regards to the life cycle. All these differing aspects will then help to identify the strategic choices available to Mitchells and Butler.

The report then looks at the financial side of the organisation using three financial statements: Cash Flow, Balance Sheet and 5 year income statement. These are analysed to review sales trends and profit trends. A SWOT Analysis has been drawn out which helped in the completion of the TOWS matrix. The TOWS matrix combined with the SFA model identify areas where Mitchells and Butler can grow.

To conclude the report, all the data was collected and analysed to suggest short, medium and long term plans for Mitchells and Butler.

Introduction.

This report is the second part of a two part report which will analyse both the internal and external factors that influence the Mitchell's and Butler's organisation. A strategic analysis of the company has already been carried, which can be seen in Appendix 1. It involved carrying out analysis on the vision, mission, values and objectives of M+B. This report will focus on the strategies that Mitchells and Butler implement in order to grow. The report will firstly look at the Micro and Macro external environment using tools such as PESTLE, SWOT, Porter's five forces model and competitor gap analysis which will combine to give a competitor analysis.

Once the external analysis is complete the report will then focus its attention on the internal analysis. This will involve analysing Mitchell's and Butler's core competencies by conducting a portfolio analysis. Based upon these analysis the report will then finish with recommendations of the future strategic choice and direction of the company followed by a short, medium and long term plan for Mitchell's and Butler's.

The business report will use David F (1988) comprehensive strategic management model as a guideline in order to cover all aspects of the strategic report. As mentioned above Vision and mission statements have already been analysed, th erefore this report will start on performing both internal and external audits.

1. External Analysis

“A company's marketing environment consists of the actors and forces outside marketing that affect marketing management's ability to develop and maintain successful relationships with its target customers. Successful companies know the vital importance of constantly watching and adapting to the companies environment”. (Kotler, P et al. 2008)

1.1 Macro Environment

Carrying out external analysis allows firms to adapt quickly to the changing environment. The macro environment is the “complete social context in which the organisation resides”. Carrol, A + Buchholtz, A (2008) Kotler, P et al. (2008) also includes that it is the larger societal forces that affect the whole microenvironment. He states that there are six major forces in a company's macro environment:

- Political

- Economic

- Social

- Technological

- Legal

- Environmental

1.2 PESTLE Analysis

PESTEL analysis categorises the factors that effect an organisation externally. Johnson, Scholes and Whittington (2005) note that many of these factors are linked. When one factor changes it can have a knock on effect on other factors. As these factors change they affect the competitive environment in which the organisation operates in, as a result it is crucial that organisations are aware of the changes in the external environment.

Political

Licensing Laws- Mitchells and Butlers have a minimum requirement to follow all licensing laws lay down by the government. If at any time they come in breach of these licenses they place themselves in serious jeopardy with the federal agencies.

Smoking Ban- The smoking ban, introduced in July 2007, had a serious effect on all of Mitchells and Butlers managed pubs and restaurants. The ban meant that no establishment was to allow smoking in any of its premises.

Economic

Unemployment- With the UK, along with the rest of the world, going further and further into a recession, companies look to try and cut costs by lowering the number of staff, therefore unemployment rises. A report written in the TimesOnline website by Gráinne Gilmore in February 2009 highlights some facts and figures which can affect consumers disposable income. In it he states that unemployment rose close to two million and predictions have been made that the figure could rise to three million by next year, the highest level since 1986.

Tax Increase- With taxes expected to rise in January 2010, consumer spending will slow down.

Inflation - The rise of inflation makes it harder for people to borrow as the banks

Social

Social Responsibility - As the leading operator of managed pubs and pub restaurants in the UK, Mitchells and Butlers has a commitment to give the responsible retailing of alcohol. Mitchells and Butlers established a policy for retailing alcohol in a responsible manner. This ensures that all of their licensed premises are operated responsibly.

Under age Drinking - Mitchells and Butlers launched the “Challenge 21” campaign, which was aimed at stopping/ reducing the number of under aged drinkers in their managed premises a.

Healthy Eating - Due to the increased awareness of healthy eating through government ad campaigns, celebrity chefs etc Mitchells and Butlers has to be aware of the varying attitudes towards healthy eating. As a result they offer a wide variety of dishes on there menus across all their differing brands. They look to offer a good choice of healthy options at the same time as offering more indulgent dishes. Mitchells and Butlers are continually creating fresh dishes with an emphasis on nutritional value.

Legal

Minimum Wage - The National Minimum wage was introduced 10 years ago and has increased 5.5% year. Mitchells and Butler must comply with the minimum pay levels for each age group to comply with the law.

Health and Safety at Work act 1974 - The Act is the primary piece of legislation covering occupational health and safety in the United Kingdom. (hse.gov.uk, 2009) Mitchells and Butlers must ensure that they enforce the health and safety of both there workforce and their customers.

Environmental

Weather - Due to the varying weather conditions throughout the whole year, Mitchells and Butlers should be constantly aware of the effects good and bad weather can have on there outlets.

Recycling - Due to raised awareness of pollution in the environment and the effects of waste Mitchells and Butlers have to show there commitment in creating as little waste as possible, and where possible recycle as much of their waste as possible. They also have a commitment to reducing there carbon footprint which can be done by the recycling of used cooking oil which is then converted into bio-diesel.

1.3 Microenvironment

“The microenvironment consists of the actors close to the company that affect its ability to serve its customers: the company, suppliers, marketing intermediaries,rs and publics”. Kotler, P et al. (2008) It is the environment with components that have specific and immediate implications for managing the organisation. Decisions made involving the microenvironment have a direct effect on the organisation. It can be controlled by the company and analysis at this level is firm specific. Xu, J.(2005)

There are many models that can help firms to measure the position they are in within their environment.

1.4 Porters Five Forces

The Objective of performing industry analysis is to develop an organisations competitive advantage in order to be more successful than its competitors. The way in which this can be done is by using Porters Five Forces Model. ( Lynch, 2003) In it he identifies the five basic forces that can have an effect on an organisation.

Bargaining power Threat of

Of suppliers new entrants

The report will now go into further detail of each threat, identifying the different aspects of each factor and the affect they could have on Mitchells and Butler.

Threat of Entry

With Mitchells and Butlers being the leading operator of managed pubs and pub restaurants, they must be aware of any potential threats that may arise from new entries in the market. The industry in which Mitchells and Butlers operates is one where barriers to entry are very low and therefore easy for new organisations to enter the market. However due to the sheer size of the organisation they have an automatic advantage over any new entries.

Economies of Scale - Mitchells and Butlers are in the position to gain economies of scale due to the number of managed outlets they have. With around 2,000 businesses they have the ability to lower the costs of products because of the amount they will be ordering at one time.

Experience - Mitchells and Butlers has been operating as an independent division since 2003 but it history dates back to 1898. This unparalleled experience of the pub industry accounts for invaluable knowledge and experience which can help in the development and growth of the organisation.

Customer Loyalty - With over 2000 outlets built mainly in residential areas Mitchells and Butlers will have built up a high level of customer loyalty. This makes it increasingly difficult for new competitors to establish a loyal customer base for themselves. It is evident however that not everyone is within close proximity to a Mitchells and Butlers unit and therefore consumers will be loyal to a different business.

Product Differentiation - Mitchells and Butlers understand the importance of product differentiation and aim to deliver products of the highest quality at the lowest possible prices. It also prides itself on customer service, displaying just how important they feel it is. Mitchells and Butlers also drive to promote its own brands in order to create product differentiation.

Bargaining Power of Buyers

Concentration of buyers - With Mitchells and Butlers being in a market with a huge amount of potential buyers then it is in complete power with what price to set. If the buyers are not happy with the price then they simply have to go elsewhere as the market is big enough to attract more customers. However Mitchells and Butlers can not set the price at whatever they choose as the fierce competition in the market drives prices down and they have to compete with there rivals for customers.

Product Differentiation - With so many other options available for the buyer Mitchells and Butlers has to be able to differentiate itself from the rest of the market. They do this buy offering the highest quality at the lowest possible prices. It also prides itself on customer service, displaying just how important they feel it is. Mitchells and Butlers also drive to promote its own brands in order to create product differentiation.

Bargaining Power of Suppliers

Mitchells and Butlers is in a very strong position when it comes to its bargaining power with its suppliers. They are the leading operator in managed pubs and pubs restaurants with the largest market share. Suppliers will have to listen to what they are demanding or else they face loosing a huge amount of revenue.

Threat of Substitutes Products or services

There is a large threat of substitutes that are available from supermarkets. The off trade market that is now available to potential consumers is a huge threat to Mitchells and Butlers. With the constant promotion of alcoholic beverages from the large supermarket chains such as Tesco's, Sainsbury's and Morrison's means that Mitchells and Butlers have to differentiate themselves from this market and establish themselves as offering an experience and a service rather than just solely a product.

The supermarkets also advertise deals such as “ TWO CAN DINE IN FOR £10”. This such advertisement was ran by M&S. Being a differentiated product will entice potential consumers towards it.

Threat of Rivalry

In a market where growth is slow and competition very high, Mitchells and Butlers have created rivalry by becoming the leading operator in its markets and taking a lot of customers from its competitors. However it does not face rivalry from small independent outlets as they focus their attention away from the big rivals.

The way in which Mitchells and Butlers create rivalry is by the pricing policy on drinks. Being the leading operator in managed pubs means that they are able to buy in bulk reducing the costs of products. With relation to food Mitchells and Butlers has a variety of brands that are in varying markets that can capture different customers with the varying levels of quality and price. For example the harvester brand is aimed at the lower end of the market, whereas the Browns brand is at the other end of the spectrum, catering for the higher end customers.

2.0 Internal Analysis

The process of performing an internal analysis is similar to that of an external analysis. Representative managers and employees from throughout the firm need to be involved in determining a firm's strengths and weaknesses. The internal analysis involves collecting information about the firm's management, marketing, finance and operations. The gathering of this information is a great benefit to managers and employees as they get to know how their work affects other areas and activities of the organisation. Performing an internal analysis is an excellent way of improving the process of communication within an organisation. (David, 1999)

2.1Portfolio Analysis

Campbell et al (2002 p. 107) defines a portfolio analysis as an “Underpinning concept that is a need for a business to spread its opportunity and risk. A broad portfolio signifies that a business has a presence in a wide range of product and market sectors. Conversely, a narrow portfolio implies that the organisation operates in only a few or even in one product or market sector. A broad portfolio offers the advantage of robustness in that a downturn in one market will not threaten the whole company”

It is essential that Mitchells and Butlers carry out a portfolio analysis as they operate in many different markets resulting in a number of different cashflows from there brands.

2.2 BCG Matrix

The Boston consultancy matrix identifies the relationship between market share and growth of a business. It offers a way of examining a company's portfolio of product and market interests. (Campbell et al 2002)

Mitchells and Butler would be classed as a cash cow. Being the leading operator in managed pubs they have the largest share of the market. However the market in which they are positioned is one that is maturing. Growth for Mitchells and Butlers is slow and the condition of the market is stable.

Below is a diagram which converts the BCG matrix into the product life cycle.

There are many brands associated with Mitchells and Butler which are in varying stages of their life cycle. The next stage of the report is to show an example of brands in there different stages of the life cycle. The use of this is that it allows Mitchells and Butlers to identify which of their brands are in the decline stage and come up with either new strategies/ products in order for it to grow again.

2.3 The Life Cycle Model

2.4GE-McKinsey Matrix

An alternative way in which to evaluate the portfolio of an organisation is by a directional policy matrix/ GE-McKinsey matrix. This matrix categorises an organisations business units into those with good prospects and those with less good prospects. The matrix positions units according to how attractive the market is in which they operate and secondly through the competitive strength of the SBU in that market. (Johnson, Scholes and Whittington, R. 2009)

2.5 Resource Based view of Mitchells and Butler

The resource based view of a firm is a model of an organisations performance that focuses solely on the resources and capabilities controlled by a firm as sources of competitive advantage. (Wernerfelt, B. 1984, cited in Barney, J & Hesterley, W. 2006)

Resources are defined as the tangible and intangible assets that an organisation controls whereas capabilities are a “subset of a firms resources and are defined as tangible and intangible assets that enable a firm to take full advantage of other resources it controls”.( Barney, J & Hesterley, W. 2006. p.76)

Barney & Hesterley (2006) also state that there are four main categories in which resources and capabilities can be classified into four main sub categories: Financial resources, Physical resources, Human resources and organisational resources.

M & B Financial resources and Capabilities

Two loans: One of £2.3 billion which is secured against the assets and cash flow of he business. The second is an unsecured loan of £550 million from a number of major banks.

Cash generated through sales of products and services.

M & B Physical resources and Capabilities

Property, plant and equipment.

Computer Software.

Leases: Both operating leases and financial leases.

Reputation

M & B Human resources and Capabilities

Operated by an experienced senior management team.

Committed to training and investing in their employees to enable them to develop their skills and experience.

M & B Organisational resources and Capabilities

Relationships between the different levels of management.

Clear communication

Importance of team building in each business unit.

Experience of senior management.

Training programmes at operational level.

Mitchells and Butler use their capabilities to turn their resources into products or services. For instance it uses its reputation to increase its financial resources.

2.6 Core Competencies

“Core competencies are the skills and abilities by which resources are deployed through an organisations activities and processes such as to achieve competitive advantage in ways that others cannot imitate or obtain”. (Johnson, Scholes, and Whittington, 2008. p. 97)

This is no more important than in a recession, Mitchells and Butlers needs to focus on its core competencies in order to cerate competitor advantage and steal, what is, a diminishing number of, customers.

2.7 The VRIO Framework

VRIO is an acronym for 4 questions that can be used in order to assess the competitive advantage that can be gained from resources and capabilities. The VRIO framework allows an organisation to assess its resources and capabilities potential to create a competitive advantage. ”( Barney, J & Hesterley, W. 2006. p.76)

The Question of Value

Mitchells and Butlers uses its resources and capabilities in order to create competitive advantage and stay the leading operator in managed pubs and restaurants. Its organisational resources and capabilities has equated to the acquiring of 239 pub restaurants from Whitbread plc in 2006. The financial capabilities plus experience of management team means that they can cope in a period of financial downturn.

The Question of Rarity

With Mitchells and Butler being in such a saturated market where growth is very slow and product differentiation hard to achieve then its physical resources and capabilities create very little competitive advantage. It is its organisational, human and financial resources that create it. The size, experience, knowledge, training, quality, price create competitive advantage over a long period of time.

The Question of Inimitability

This question aims at identifying an organisations strength against any competitors trying to imitate their products or services. For Mitchells and Butler although it may be easy to copy its tangible resources, it is certainly not easy to imitate their intangible capabilities. With over 100 years of experience in the pub trade gives them invaluable experience and knowledge of the industry. The senior management team has over 15 years of experience and the board of executive directors have worked on the strategy and development of Mitchells & Butlers since 1995. (mbplc.com - “our management”) [Cited 14/12/2009]

The Question of Organisation

Although Mitchells and Butler may have competitive advantage with its resources and capabilities, in the above three questions, it can not continually create a competitive advantage unless they are an organised company. The senior management team must work together in order to create systems, policies and procedures in which each individual unit runs at its optimum level. This is done by vertical communication between the varying different levels of operation.

2.8Value-Chain Analysis

A Value chain “is the set of business activities in which a firm engages in to develop, produce, and market its product or services”. ” (Barney, J & Hesterley, W. 2006. p.83)

3.0 Financial Information

3.1 Cash Flow Statement

The cash flow statement can be seen in appendix 3.

3.2 Balance Sheet

The balance sheet is available in appendix 4.

3.3 5 year Income Statement

Available in Appendix 5.

From analysing the above financial information, one can draw the major trends from the financial year 2008.

Sales Trend

Analysing the 5 year review one can see a major difference in the sales trend. Turnover has increased to £1,908 million over the year which is a 0.7% increase over the financial year. However

Profit Trend

Although there was an increase in revenue there was a significant decrease in operating profit. From the previous year there is a huge drop from £309 million to £131 million a gap of £178 million. A reason for this could be due to the amount of money they had to repay on a loan they took out to cover the costs of an abandoned joint venture.

Mitchells and Butler decided to reduce its level of “unsecured medium term debt”. (mbplc.com. 2009) Looking at the 5 year report one can see that the dividend pay out was £18 million, compared to the previous 4 years ,it is on average around £33 million less. To do this they paid an interim dividend of 4.55p per share which is represented on the income statement. This was paid on the 27th June 2009.

The short-term loan of £550m has to be paid down to £400m by the end of 2009 and then down to £300m by the end of 2010. Mitchells and Butler have managed to get the loan amount down to £475 million. The organisation is aiming to bring capital expenditure down to £120 million whilst selling some of its pubs along the way. This is a way in which they will pay back the £550 million loan, however it will have a huge effect on the size of the business and its net profit in the next financial year. (Hall, 2009)

Below is a list of further trends that were available from the corporate profile September 2009.

Major Trends 2008

Turnover- £1,908m up 0.7%

EBITDA- £477m up 1.1%

Operating profit- £343m -

Profit before tax- £179m down 13.5%

Earnings per share- 31.5p down 11.3%

Before exceptional terms and IAS 39 movements.

Source mbplc.com- corporate profile September 2009 (Appendix 6)

3.4 Balanced Scorecard

Financial L4L growth turnover and profit, ROI on investment and acquisition, total capital expended, rent/lease review uplifts, assignment premiums Internal Business Processes Mitchells and Butler have both long and short hold leases.

IT systems - Mitchells & Butlers is reliant on its IT systems to trade efficiently and to ensure that appropriate controls are in place

Learning and Growth

Graduate Programs are in place for two different areas: The Corporate Graduate Scheme and the Retail Graduate Scheme

Training given at all operational levels. Employees must be able to work to the standards set by the Mitchells and Butler legacy.

Customer

Service Standards - Service standards have a huge impact on Mitchells and Butlers success. Service standards are a key element in the choice of consumer's pub.

Employee satisfaction survey, retailer satisfaction survey, Now to Wow, mystery customer, retailer complaint levels, customer complaint levels

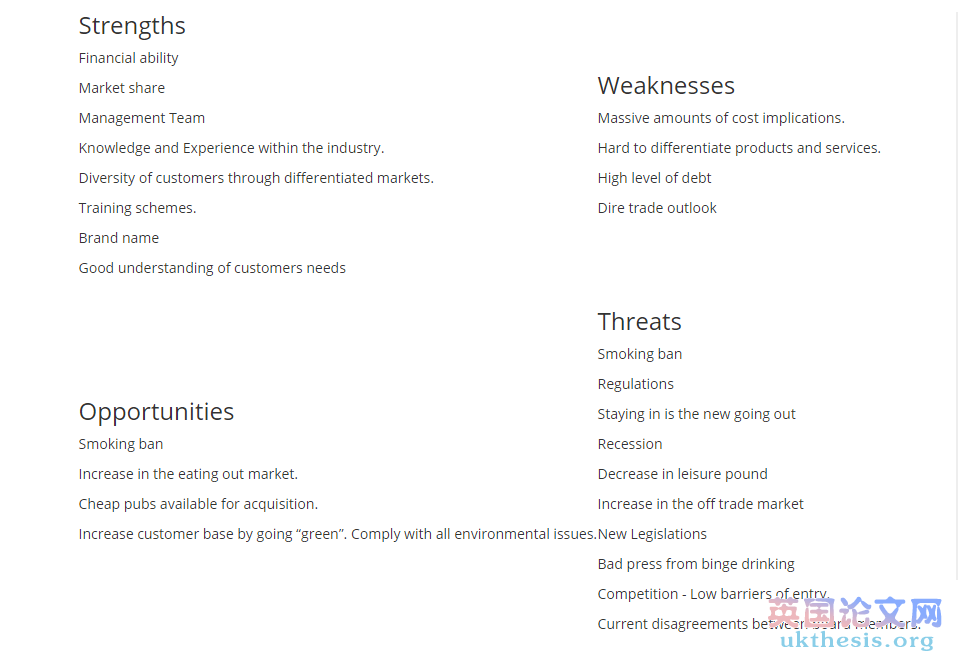

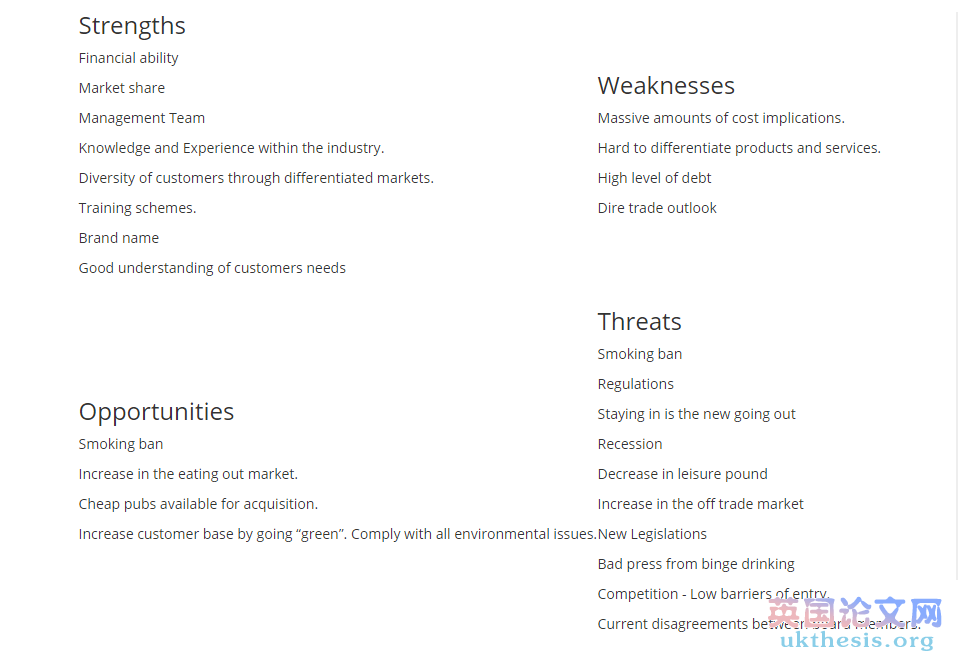

3.5SWOT Analysis

4.0 Strategic Choice

In order for M&B to develop further, they must look at the different strategic options. They need to ask themselves 5 questions:

What do we want in life?

On WHAT basis are we to compete?

WHEN do we implement these?

WHICH direction?

HOW?

Patton, F(2009)

4.1 Porters Generic Strategies

Porters two parameters: “a company can seek to compete” and the market in which a company seeks to compete can be broad or narrow, led him to construct the three generic strategies seen below. (Thomson, 2001)

Patton, F (2009) Porter's model of generic strategies. Adapted from Porter, M(1985) Competitive Advantage: Creating and Sustaining Superior Performance.

Mitchells and Butlers uses the Differentiation strategy. It offers a range of differentiated products across a number of markets. The different brands in the organisation ensure that they appeal to the whole market. A way of expressing how M&B use the differentiated strategy is to look at the different brands and the markets they operate in.

Cost/ Price Focus:

Crown Carveries- “Top quality carvery meals at great prices…..”

Differentiation Focus

Harvester - “Family-friendly restaurants serving freshly-prepared grills, spit-roasts and fish dishes and the famous salad cart, included with every meal”.

Cost Leadership

Ember Inns - “Quality local pubs providing customers with a relaxed home from home and a great range of cask ales, wines and tempting, traditional pub food favourites with a modern twist”.

4.2 Strategy Clock

The strategy clock was developed by Cliff Bowman. The clock is based around price and the perceived value the customer will gain from the product or service. Mitchells and Butlers can use the strategic clock to choose where they wish to position a brand or business unit. It represents different positions in a market where potential customers have different requirements in terms of value for money. (Johnson, Scholes and Whittington, 2008. p224)

Mitchells and Butler are positioned between the hybrid and differentiation stage. They aim to provide products and services that are different to that of their competitors in a range of different markets however in certain brands e.g. harvester their strategy is to offer lower cost meals.

For a more in depth explanation of Bowman's strategy clock please see Appendix 6.

4.3 The Ansoff matrix

Johnson, Scholes and Whittington, R (2009) state that the Ansoff matrix provides a simple way of showing the four different directions of strategic development. They state that an organisation starts in the top left hand box. It then has a choice between penetrating further within its existing sphere, move to the right and develop new products for its existing markets; moving downwards bringing its existing products into new markets: or move diagonally down, which involves full diversification where the organisation enters new markets with new products. Adapted from Ansoff, H (1988)

The diagram above was taken from an internet site: http://strategyiseverywhere. However the model is exactly the same across all literature.

Mitchells and Butlers strategic development direction is one which uses market penetration, market development and Product Development.

Market Penetration

Market penetration involves the organisation taking an increased share of its existing markets with the same product range. It does not involve an organisation having to venture into unfamiliar territory. The advantage of market penetration is that it increases power over both suppliers and buyers. (Johnson, Scholes and Whittington, R 2009)

Mitchells and Butlers used market penetration as a growth strategy by building, buying and acquiring more and more pubs. It is now the leader in managed pubs and pub restaurants within the industry with around 2,000 businesses.

Market Development

Market development involves an organisation offering existing products to new markets. This can be done by exploiting products in other markets, developing new uses for existing products or geographically spreading them into new markets. (Johnson, Scholes and Whittington, R 2009)

The Diagram in Appendix 7 shows the extent to which Mitchells and Butlers has developed in differing markets. For example Flares is very much a brand orientated around drinking and located in city centres, whereas Harvester is predominantly food led and located in residential areas. They also have a brand which has developed the market geographically. The brand “Alex” is a chain of city centre bars located in Germany.

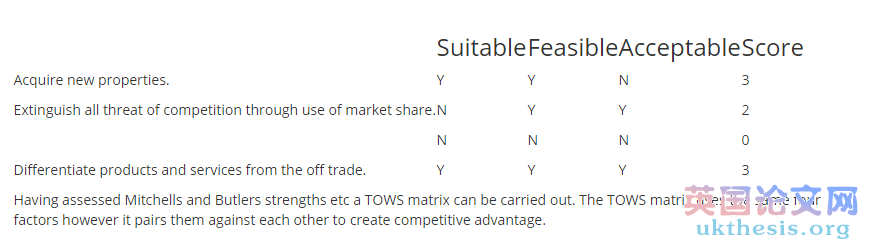

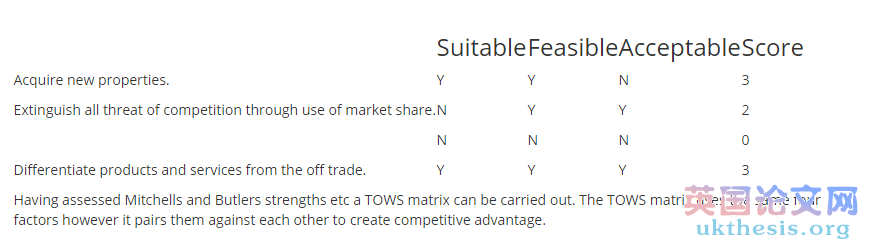

4.4 SFA Test

The SFA test is an abbreviation for the words, suitability, feasibility, acceptability. It is a way of scoring strategies that are being considered for the future of an organisation. The suitability test relates to the strategic fit to an organisation. The feasibility test is to see whether the strategy can actually be carried out. Finally acceptability tests to see if the strategy is acceptable to stakeholders.

Having assessed Mitchells and Butlers strengths etc a TOWS matrix can be carried out. The TOWS matrix uses the same four factors however it pairs them against each other to create competitive advantage.

3.6 TOWS Matrix

The TOWS matrix was developed so that organisations could analyse the competitive situation of an organisation. The matrix involves four different strategies. “The TOWS matrix is a conceptual framework for a systematic analysis that facilitates matching the external threats and opportunities with the internal weaknesses and strengths of the organisation”. (Koontz & Weihrich, 2006. p. 107)

For more detail of each of the TOWS matrix strategies use Appendix 7.

3.7 Mitchells and Butler TOWS matrix

SO Strategy

This strategy looks at combining Mitchells and Butlers internal strengths with its external opportunities. Carried out correctly, this strategy can be the most successful. According to O'Conner (2009) a rate of 52 pubs closing every week. This gives M&B, with their financial strength, to essentially buy cheap pubs and increase the business portfolio

ST Strategy

This strategy involves the use of strengths to either cope with threats or avoid them altogether. Mitchells and Butler cope with the threat of competition in the market due to the market share it has. It is highly unlikely that a company will come into the market with a share that is big enough to rival that of Mitchells and Butler.

WO Strategy

This strategy is aimed at overcoming organisations weaknesses in order to take advantage of its opportunities.

WT Strategy

These strategies are aimed at minimising both the weaknesses and the threats. The way in which Mitchells and Butlers can do this is by differentiating its products and services from the threat it faces from the off trade.

5.1 Short Term Plan.

In the current economic climate Mitchells and Butler should prioritise in retaining its market strength through its diverse range of brands. With the economy becoming weaker and weaker by the week its main priority should be retaining a customers. This can be done by price promotion on certain products and by using its resources and capabilities to differentiate it from its competitors. Maximise the value of its estate is also a key strategy.#p#分页标题#e#

5.2 Medium Term Plan

5.3 Long Term Plan

Its long term plan should be one that focuses on life after the recession and the position it will be in 10 - 15 years from now. Mitchells and Butler have increased there revenue by 0.7% which shows their strength in a market which is hugely affected by the state of the economy. Implementing the same strategies as they have now which are aimed at cutting costs as well as growing the business will be a winning formula for a market leader. They should seek growth via horizontal integration of competitors, market penetration and product development.

6.0 Conclusion

The report has analysed in detail the different strategies that Mitchells and Butler can undertake in order to grow. Through External and internal analysis, of the organisation, the report has clearly identified its resources and capabilities, core competencies, strengths, weaknesses, opportunities and threats. Drawing from all of the models used has helped to identify the direction that Mitchells and Butler is heading with its strategies.