汽车销售市场分析dissertation范文-FOTON authority’s motorcycle marketing research

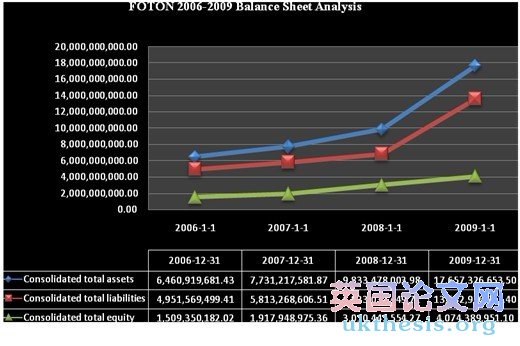

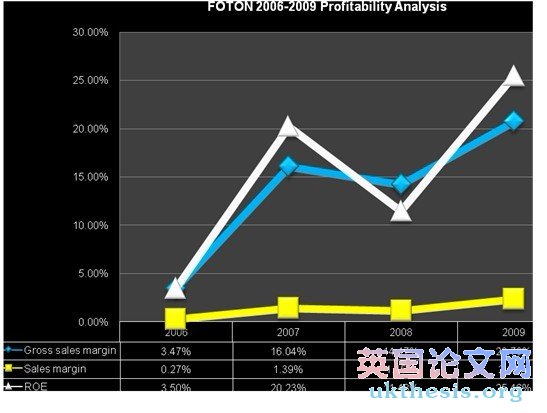

福田汽车销售市场分析dissertationFrom the chart we can see, from 2006 to 2009 the total asset, total liabilities and total equity are always increasing. In 2009, the three items increase faster than other periods. So we can say, the FOTON Company has a huge increase in 2009. We think with the help of authority’s motorcycle policy, FOTON will have a better grow in the future.

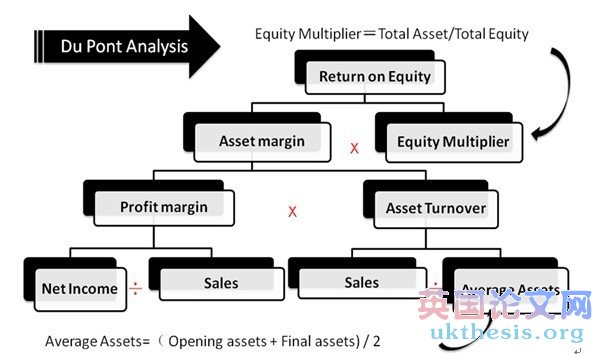

ROE is one of the most important indexes, there is a developed theory called Du Pont Analysis. Du Pont Analysis spilt ROE into Asset margin and Equity Multiplier, and we can also spilt Asset margin into Profit margin and Asset Turnover. To profit margin, it tells us how much profit a company makes for every $1 it generates in revenue or sales. Profit margins vary by industry, but all else being equal, the higher a company's profit margin compared to its competitors, the better. Asset turnover measures a firm's efficiency at using its assets in generating sales or revenue - the higher the number the better. It also indicates pricing strategy: companies with low profit margins tend to have high asset turnover, while those with high profit margins have low asset turnover.

Du Pont Analysis

Year 2007 2008 2009

Profit margin 1.39% 1.15% 2.31%

Asset Turnover 3.6 3.06 2.54

Equity Multiplier 4.03 3.27 4.33

ROE 20.23% 11.48% 25.46%

找到行业数据,根据行业数据来具体分析该图

From this chart, we can see the return on asset of FOTON Company has a decline in 2008, but in 2009, in increase back to almost 8%. ROA tells us what earnings were generated from invested capital (assets). ROA for public companies can vary substantially and will be highly dependent on the industry. This is why when using ROA as a comparative measure, it is best to compare it against a company's previous ROA numbers or the ROA of a similar company.#p#分页标题#e#

与行业进行比较

The revenue of FOTON from 2006 to 2009 is always increasing. It increase 7.91% in 2008, this is mainly caused by the world financial crisis. FOTON’s revenue increase 49.1% in 2009, the number shows FOTON Company is in a quick development after the great depression.http://www.ukthesis.org/dissertation_writing/Marketing/2012/0208/1046.html

This chart shows the changes of opening cost from 2006 to 2009. The opening cost of FOTON Company increase 44.13%, the number is a litter less than the increase of revenue in 2009. The FOTON Company should try to control the increase of opening cost in an reasonable range, not too high even they are in the process of growth.

The chart shows the changes of FOTON Company from 2006 to 2009, there is a decrease in 2008 because the bad economic environment, most of company’s net income has a decrease in 2008. When the economic revives, the net income of FOTON Company has a quick rise, it has increased more than 200% than 2008.

When we measure the liquidity of a company, the most useful indexes are current ratio and acid-test ratio. Current ratio can be misleading because the chances of a company ever needing to liquidate all its assets to meet liabilities are very slim indeed. It is often more useful to consider a company as a going concern, in which case you need to understand the time it takes to convert assets into cash, as well as the current ratio. The current ratio should be at least between 1.5 and 2, a ratio of less than 1 (that is, where the current liabilities exceed the current assets) could mean that you are unable to meet debts as they fall due, in which case you are insolvent. A high current ratio could indicate that too much money is tied up in current assets—for example, giving customers too much credit.

与行业进行比较

The acid-test ratio should be around 0.7–1, with very few companies having a cash ratio of over 1. To be absolutely safe, the quick ratio should be at least 1, which indicates that quick assets exceed current liabilities. If the current ratio is rising and the quick ratio is static, this suggests a potential stockholding problem.

与行业进行比较

Leverage ratio can tell us how much liabilities a company have used especially debt to equity ratio. From the chart we can see, the average ratio of FOTON Company from 2006 to 2009 is more than 70%, and far more than the industry average. A high debt/equity ratio generally means that FOTON Company has been aggressive in financing its growth with debt. This can result in volatile earnings as a result of the additional interest expense. If a lot of debt is used to finance increased operations (high debt to equity), the company could potentially generate more earnings than it would have without this outside financing. If this were to increase earnings by a greater amount than the debt cost (interest), then the shareholders benefit as more earnings are being spread among the same amount of shareholders. However, the cost of this debt financing may outweigh the return that the company generates on the debt through investment and business activities and become too much for the company to handle. This can lead to bankruptcy, which would leave shareholders with nothing. So if the company was in a fast development and the industrial environment is fine, higher leverage ratio is in a reasonable range. To make a further analysis, we can use interest protection multiple to identity whether the FOTON Company’s high leverage is very dangerous or not.#p#分页标题#e#

Interest protection multiples tells us the ability of FOTON Company to pay its interest expense. For this figure, the higher, the better. Before 2008, FOTON Company’s interest protection multiple is always lower than industry average. In 2008, the interest protection multiple is only 3.38, much lower than the industry average 16.35. It is caused by the decline of income in 2008 and a high interest expense. FOTON Company is mainly focus on courage production, so it is more easily affect by the total economic environment. With the help of government policy and the economic recovery, the interest protection multiple is almost as twice as industry average. So in a conclusion, even the leverage ratio of FOTON Company is very high, they still have the ability to handle the risk.

Current asset turnover indicates how efficiently a firm is using its current assets to generate revenue. If we use 360 divided by current asset turnover, then we will get current assets turnover in days. For this index, the smaller, the better. For future analysis the asset management capabilities, we can see clearly from the chart below.

The total assets turnover can reflect the whole asset management capability, in generally, the higher the better. From the chart we can see, no matter the current assets turnover or the total assets turnover, FOTON Company is much better than the industry average. From these comparisons, we can say the FOTON Company’s operating capability is very strong.

The Inventory turnover is a measure of the number of times inventory is sold or used in a time period such as a year. The inventory turnover of FOTON Company is very high, it means the selling of their products don’t need too much time.

与行业进行比较

The receivable turnover ratio measures the number of times, on average, and receivables are collected during the period. Comparing the FOTON Company with industrial average, the receivable turnover ratio of FOTON Company is much better than industrial average. So we can see that FOTON Company pays a lot of attention on cash flow.

This chart shows from 2006 to 2009, the trend of EPS of FOTON Company is increasing in average. The earnings per share are generally considered to be the single most important variable in determining a share's price. It is also a major component used to calculate the price-to-earnings valuation ratio.

与行业进行比较

汽车销售市场分析dissertationThere two chart are static P/E and P/B ratio, in reality, we usually observe the dynamitic P/E and P/B ratio. However, the trend of static P/E and P/B ratio tells us the same information as the trend of EPS.

This chart is a summary of most of the indexes analysis before. This chart also show the relationship between each index. If we use Net Profit/Pretax Profit multiple Pretax Profit/EBIT multiple EBIT/Sales multiple Sales/Assets and multiple Asset/Equity, then we can get ROA. Compound Leverage Factor also can split into Pretax Profit/EBIT and Assets/Equity. Apart from this, using EBIT/Sales multiple Sales/Assets, then we can get ROA.#p#分页标题#e#