Development Economics-发展经济学留学生dissertation写作参考-Millennium Development

Development Economics

This essay aims to identify the “Millennium Development Goals” (MDGs) in their various respects and to analyse and explore them, discussing whether the proposed targets can be met and investigating where the goals are failing and why. The findings will attempt to explain and conclude if the “Millennium Development Goals” will be reached accordingly.

In September 2000, at a UN Summit in New York, 189 global leaders agreed to sign the “Millennium Declaration” to commit themselves to aid development in impoverished countries to stem the development gap and to begin tackling problems that exist in the developing world.

The MDGs are a comprehensive set of goals and targets established, following a decline in Official Development Aid (ODA) in the 1990s, to improve international relations, in particular between developed and developing nations, and to address the issues of providing freedom and equality to people around the world. This new initiative was sparked thanks to a drive to enhance the UN’s global governance and activity in the 21st century. Kofi A Annan – the Secretary General of the United Nations – wrote: “We must do more than talk about our future... We must start to create it, now.” – Back cover, Annan, K.

A total of eight goals formed the framework of the MDGs:

1. Eradicate Extreme Poverty and Hunger

2. Achieve Universal Primary Education

3. Promote Gender Equality And Empower Women

4. Reduce Child Mortality Rates

5. Improve Maternal Health

6. Combat HIV/AIDs, Malaria and other diseases

7. Ensure Environmental Sustainability

8. Develop a Global Partnership for Development

Source: United Nations, Millennium Development Goals

The fundamental purpose of the Millennium Development Goals from their inception has been to promote international economic relations. With this in mind, it is important to discuss the effectiveness of the goals in the respect that they support this notion.

Human health, freedom and rights to education, poverty reduction and ensuring a sustainable future for both the environment and the economy are all important factors towards attaining the goal of globalisation. All eight of the Millennium Development Goals are interlinked, and have been carefully designed to include elements that are important towards building and creating the idyllic globalised economy.

The considerations that need to be taken to deduce that the goals can be achieved include; the quantity of financial aid necessary and how that finance will be generated, the effectiveness of the actions adopted by the different agencies and actors, and an evaluation of the feasibility of the goals. These points will be further explored and examined in the following text.

According to the World Bank, the quantity of foreign aid required to meet the Millennium Development Goals in 2002 was “around $40 billion to $60 billion in addition foreign aid [per year].”—p.1 World Bank (2002)#p#分页标题#e#

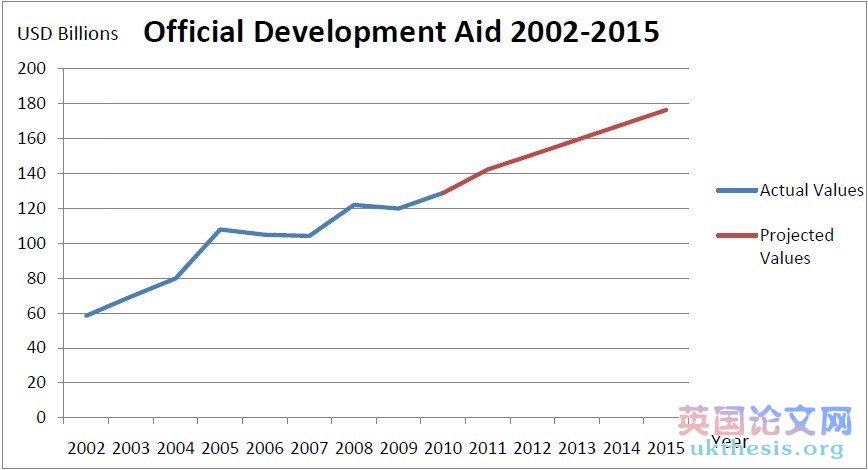

The initial financial aid is expected to be generated by Official Development Assistance (ODA) – aid from developed economies to promote the continual development of struggling nations, which raised $128.9 billion in 2010 up from $58.6 billion in 2002.

http://www.ukthesis.org/dissertation_writing/Ecommerce/2011/1124/976.htmlFIGURE A.

Source: OECD Statistics 2011

From Figure A, we can ascertain that the as of 2005, the finance required to meet the Millennium Development Goals was on track according to the World Bank’s 2002 estimations. If the current trend continues, by 2015 the expected ODA will be $176.3 billion. [Projection estimated using linear regression and trend analysis]

We can see that the financial expectations can be met over the course of the fourteen year period from 2002-2015 and thus, looking purely from a financial perspective there is the possibility that the goals can be reached.

This is however, just one of a number of factors towards attaining the goals.

Another factor that should be considered is; are the actors and agencies implementing their actions and processes to achieve the goals effectively?

0

20

40

60

80

100

120

140

160

180

200

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Actual Values

Projected Values

Official Development Aid 2002-2015

USD Billions

Year

Where time, resources and money are being spent, it is important that the intended purpose or aims of using these elements are achieved.

For example, flooding a country with too much credit and capital can cause absorption problems with the result of wasted finance.

Therefore, it is important to invest in countries where investment is required and to invest in projects that will be beneficial to future sustainability.

“foreign aid is effective in countries where the policy and institutional environment is conducive to poverty reduction.” – World Bank

From the view of a neoclassical economist, in order to sustain economic growth there are certain peremptory prerequisites. Without these prerequisites, an economy will not be prepared to absorb the given aid efficiently.

Secure property rights, low transaction costs and the capability of an economy to support capital accumulation are all of particular importance. For clarity, a brief explanation of why these economic factors are so important will be presented.

Property rights pave the way for a person to authorise how resources are allocated. The most important aspect of property rights is that the property can be appropriated without fear of losing the property due to force or violence.#p#分页标题#e#英国dissertation网-发展经济学留学生dissertation写作

“Commerce and manufactures can seldom flourish long in any state, which does not enjoy a regular administration of justice; in which people do not feel themselves secure in the possession of their property” – p. 660, Smith, A.

So this induces the question, what are the implications that a lack of property rights has on poverty?

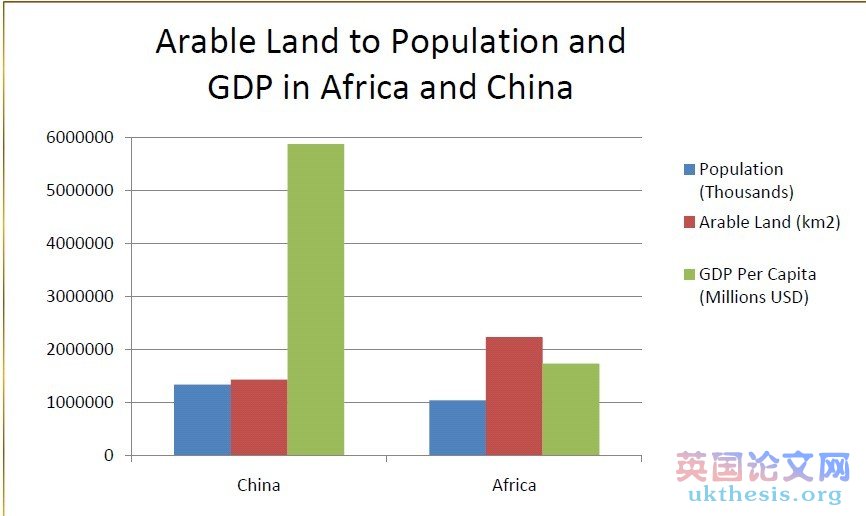

One of the aims of the UN is to halve the proportion of people living in poverty and the proportion of malnourished people. Currently, Africa has the largest proportion of impoverished and starving people in the world. However, one asset Africa has in abundance is land, something that could also be very valuable towards Africa’s economic development.

Taking a look at the resources Africa has can give an insight into whether poverty reduction is achievable. A comparison between Africa and China is displayed below in Figure B.

Sources: CIA Factbook, International Monetary Fund, Food and Agriculture Organization of the United Nations

Agriculture is a key sector for developing economies. Africa has twice as much arable land per person as China does yet cannot transform the resources into growth.

In underdeveloped economies, land can be worked and used to generate an income through the sale of crops. It can also be used as collateral to help obtain credit as a tool for investment with which to work the land.

The fundamental issue here is that economic growth is possible and there are sufficient resources.

One factor that is holding Africa back from growth is the environment and legal system. Weak property rights incentivise crime and theft. When one person invests in an asset or capital, for example a harvester for a farm, suddenly that asset becomes much more valuable and much more desirable to steal. Therefore by investing in capital, those individuals make themselves targets to the corruptive society. This is one of the main problems developing economies experience.

The aid that impoverished communities need should come in the form of changing the legal system and environment that will allow the country to be conducive to growth.

Using the knowledge of Property Rights’ importance to achieving growth, one can portend the implications they will have on the MDGs.

The MDGs will not be achieved, no matter what the extent of the quantity of finance, in a state which does not have secure property rights.

Economic growth can only thrive in a resourceful, secure and stable environment.

As explained by Mahmoud in his paper “Administrative Obstacles to Capital Accumulation in Developing Economies” capital accumulation is also important for developing economies.

0

1000000

2000000

3000000#p#分页标题#e#

4000000

5000000

6000000

China

Africa

Population (Thousands)

Arable Land (km2)

GDP Per Capita (Millions USD)

Arable Landto Population and GDP in Africa and China

Capital accumulation is the process of investing in capital that can be used to create more wealth. Capital Accumulation is only possible when an individual is able to produce more than they can consume. The excess “profit” is then invested toward buying capital with the idea that the capital will be able to create more wealth more quickly. In many impoverished countries, it is not possible to accumulate capital because there is the necessity for an initial investment to be made to kick-start the cycle.

There are two ways this capital can be generated. The first is domestically, and the second is through foreign direct investment. Both have their disincentives to either party respectively. Foreign institutions are unwilling to risk investment in a foreign corrupt country as there is a high possibility they can lose their investment.

“An individual foreign investor may not have the power, even if he had the will, to break the deadlock caused by low productivity, lack of real buying power and deficient investment incentives in the domestic economy of a backward area”- p.574 Nurkse, R.

There is also the issue, that even if the country is not corrupt, there may not be sufficient demand for an institution to justify the investment.

Domestic entities are unlikely to invest in capital in a developing country as property rights are very weak, and the investment could be become easily damaged or stolen. As explained in the previous section regarding property rights, individuals in developing countries are disincentivised to accumulate capital, and as a result economic growth can be very difficult to achieve. Neither institution nor individual will therefore take the risk in a developing economy.

A third factor that will promote growth is keeping transaction costs as low as possible. In an economy with high transaction costs, trade cannot occur.

Thus, ensuring low transaction costs is extremely important towards building an economy.

One branch of economics which has strengthened this notion is Keynesian economics. During the post-war period, the Government was required to invest in infrastructure, roads, hospitals and education. Transaction costs were lowered for those using the infrastructure and facilities, markets were formed and once again Europe experienced high economic growth, all due to Keynesian stimulus packages. “What is needed to solve the problems of the LDCs would be a long-term policy of economic growth through massive schemes of improvement through health and education of the people, and substantial investment in the infrastructure development” – p.16 Gnosh, R.

When the British colonized foreign soil in the 19th Century, one of the contributors to their success of building sustainable economic growth was the construction of infrastructure which lowered the transaction costs of trade. For instance, building rail networks allowed for a fast and efficient transport method of coal in the 19th and 20th Century. This allowed the colonies they invaded to grow very quickly including, Australia, British India, Hong Kong and South Africa.#p#分页标题#e#

Finally, and perhaps most importantly, are the goals realistic?

To conclude the feasibility of the MDGs it is important to contrast them with previous attempts at growth and development.

There are two such attempts that are significant; The Marshall Plan and New International Economic Order.

Out of the two, the most successful was The Marshall Plan. Reasons why the Marshall Plan was so successful was due to a couple of factors. Firstly, the environment and legal system in place was advantageous for growth. The people had faith in secure property rights and so a lot of capital was invested.

Secondly, there was a surplus of resources that could be used to rebuild and reconstruct Europe after the Second World War. These are both factors that other development projects have lacked.

The New International Economic Order (NIEO) was not successful. The problems with the NIEO were that the regulations in place to try to boost growth through favourable terms of trade. The idea failed as regulators priced consumers out of the market, which caused high unemployment and harm to poorer countries. (Johnson, 1974)

Utilising the resources in impoverished regions to their maximum potential – in a safe, secure, law-enforced society with education and human capital - can create economic gains on a global scale and will bring benefits to all involved in bringing about their potential.

However, the principle is and remains that it is not possible to force developing countries to develop sustained economic growth, without first changing the conditions in which that economy can prosper. For this reason, the Millennium Development Goals cannot be met.

The United Nations fail to meet the concept of economic limits – where under certain conditions, an economy cannot grow, and it is necessary to change those limiting conditions in order to promote growth. The conclusion to this essay therefore would fittingly be - it is important to plan, however if you have the wrong plan, you will solve the wrong problem.

In the words of Milton Friedman, “The government solution to a problem is usually as bad as the problem.”

Word Count – 1,891

*Please note Figure B does not contain data from Djibouti.

References

[1] Smith, A (2008). The Wealth of Nations. Radford, VA: Wilder Publications

[2] Annan, K (2000). We the peoples: the role of the United Nations in the 21st century. London: United Nations Department of Public Information.

[3] Hulme, D (2007). The Making of the Millennium Development Goals: Human Development Meets Results based Management in an Imperfect World. Manchester: Institute for Development Poverty and Management.

[4] Johnson, H. (1974). Selected Papers. The New International Economic Order

[5] Gregory, Paul R., and Stuart, Robert C. (2001). Russian and Soviet Economic Performance and Structure, 7th Ed. New York: Addison Wesley Longman.

[6] Malinvaud, E. (1953). Econometrica. Capital Accumulation and Efficient Allocation of Resources. 21 (2), p233-268.#p#分页标题#e#英国dissertation网

[7] Saith (2006) From Universal Values to Millennium Development Goals: Lost in Translation Development and Change Volume 37, Issue 6

[8] Esterly (2009) How the Millennium Development Goals are Unfair to Africa: World Development Vol. 37, No. 1

[9] Bourguignon et al. (2008) Millennium Development Goals at Midpoint: Where do we stand and where do we need to go? CEPII

[10] Smith, J . (1992). The Failure of Internationalism. Available: http://home.alphalink.com.au/~eureka/intfai.htm. Last accessed 25th Sep 2011

[11] Anon. (2002). The Cost of Attaining the Millennium Development Goals. Available: http://www.worldbank.org/html/extdr/mdgassessment.pdf. Last accessed 25th Sep 2011.

[12] Anon. (2011). Reference DAC Statistical Tables. Available: http://www.oecd.org/document/35/0,3746,en_2649_34447_47515235_1_1_1_1,00.html. Last accessed 25th Sep 2011

[13] Vandermootele, J. (2008). The MDGs and Pro-Poor Policies: Related But Not Synonmous. Available: http://www.ukthesis.org/dissertation_writing/Ecommerce/2011/1124/976.html. Last accessed 22nd Sep 2011

[14] Nurkse, R. (1952). Some International Aspects of the Problem of Economic Development. American Economic Association. 42 (2), p.571-583

[15] Keynes, J. (2008). The General Theory of Employment, Interest and Money. New Delhi, India: Atlantic Publishers

[16] Anon. (2011). Millennium Development Goals. Available: http://www.un.org/millenniumgoals/bkgd.shtml. Last accessed 25th

[17] Mahmoud, M. (1989). Administrative Obstacles to Capital Accumulation in Developing Economies. King Saud University. 1 (1), p. 3-22.