E-business

2. E-business

2.1 What is E-business?

It is common to use the terms e-business and e-commerce as synonyms. However, there are differences between the two: e-business is broader than e-commerce. E-commerce is the exchange, procurement, and distribution of products, services, and/or payments between two or more economic entities via computers or other electronic means (Pitre, 2000). This definition is consistent with the first definition of e-commerce given by Kalakota and Whinston (1997). However, it excludes intra-organizational applications that do not interface with external entities. In contrast, e-business includes the strategies, tactics, practices, activities, and methodologies that companies apply to use information technologies to improve their business practices (Abu-Musa, 2004; Pinero, 2001).

E-business can be loosely defined as a business process that uses the Internet or other electronic medium as a channel to complete business transactions. As classified by Geoffrion and Krishnan (2001), e-business consists of three areas: (1) customer-oriented activity and (2) business-oriented activity supported by (3) the e-business technology infrastructure.

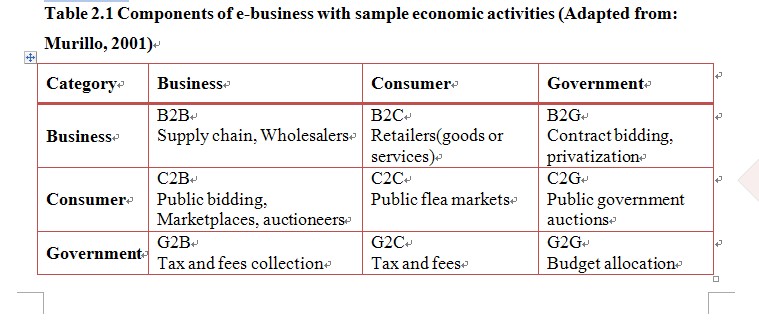

The (1) customer-oriented activity consists of the activities with customers involved such as business-to-customer (B2C), customer-to-customer (C2C), government-to-customer (G2C), etc.; the (2) business-oriented activity comprises business-to-business (B2B), business-to-government (B2G), etc. It is concluded that the scope of e-business spread across three categories: business, customers and government. See Table 2.1 to view categories and segments.

The above table illustrates the broad segments of e-business. This paper focuses on the B2C segment and excludes other segments, which is defined as the use of a variety of Internet applications that enable companies to sell goods and services directly to the end-customer on the Internet.

For (3) the e-business technology infrastructure, it is defined as the total investment in information and communications technologies (ICT) in the company, which includes hardware, software, telecommunications, electronically stored data, devices to collect and represent that data, and the people who provide IT services. Both information technology capability provided by internal groups (‘insourced’) and those outsourced to suppliers such as IBM Global Services and HP Enterprise Services (former EDS) are included as well. It is often claimed that information and communication technologies (ICT) will be for the economy what steam and machine power were to the industrial revolution (Van Hoek, 2001a:21).

2.2 Current Status of E-business in China

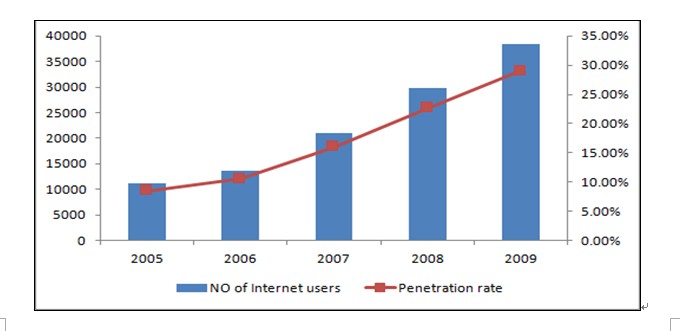

According to CNNIC (China Internet Network Information Center), by December 31, 2009, the number of Chinese Internet users and the Penetration rate of the Internet had reached 384 million and 29% respectively. The number of Internet users increased by 40 million compared with late 2008, up 28.9%, and the increase in the number of Chinese Internet users remains robust. #p#分页标题#e#

Fig 2.1: Number of Internet Users on the Chinese Mainland and Penetration Rate of the Internet (Source: CNNIC)

The number of online shoppers rose against the economic crisis by nearly 14 million from 74 million to 87.88 million, more and more Internet users were used to transparent and convenient online shopping.

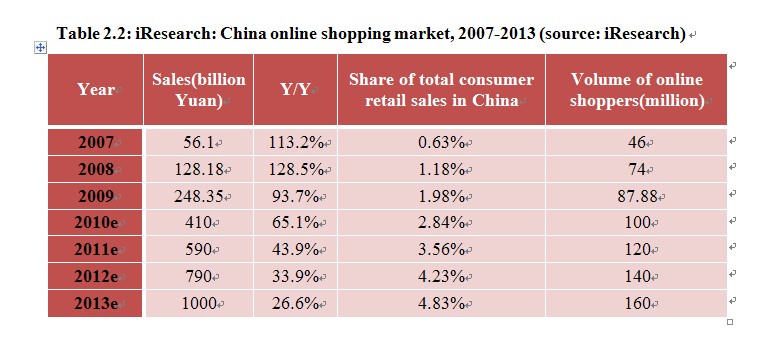

In the China market, C2C (customer to customer) and B2C (business to customer) online shopping web portals generated total sales value of 248.35 billion Yuan (EU) in 2009, increasing by 93.7% from 2008, according to China-based iResearch Consulting Group.

Table 2.2: iResearch: China online shopping market, 2007-2013 (source: iResearch)

China’s potential of online shopping is yet to be released. Additionally, the government has attached great importance to e-business’s stimulus to the economy, and has released a series of policies to regularize and guide e-business development; industry e-business also grew vigorously, with more e-business platforms emerging and more and more farsighted traditional enterprises setting out for e-business. Against the general background, e-business is expected to maintain fast growth in the coming years.

2.3 Current Development Situation of Supply Chain for E-business in China

With annual growth estimated at around 30 percent on average, China is by far the strongest developing market in the global supply chain management and logistics sector. Tremendous growth in foreign trade and direct investments, strong domestic economic development and state support for massive infrastructure investments mean that China will continue to offer great opportunities for SCM and logistics services. And as the country becomes ever more integrated into worldwide manufacturing processes, time-sensitive logistics for global supply chains will grow in importance.

Global integrators such as UPS, TNT, DHL and FedEx have been in China for two decades, and have over that time captured a large share of China’s international time-sensitive SCM and logistics market.

Local operators are very active in the domestic market and have been snapping up opportunities in an effort to stay ahead of the intense competition. While some have expanded profitably, no one has managed to capture more than 10 percent of the market.

The geographical and regulatory landscape of local Chinese logistics operations is highly fragmented. And the strong protectionism of local authorities, especially with regard to road transport, has put up significant barriers to large expansion strategies.