Accounting Case study:Jinan oil refining company

时间:2010-08-29 18:34:08 来源:www.ukthesis.org 作者:英国论文网 点击:130次

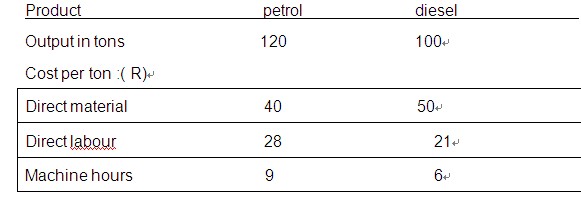

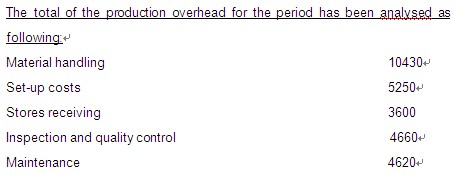

Accounting Case study:Jinan oil refining company Jinan oil refining company is a sub-company of Chinese petroleum gas incorporation, it manufactories more than 80 kind of petrochemical products such as petrol, diesel, various kerosene, liquefied gas and produces crude oil 6,300,000 tons per year. It is the biggest oil refining company in China. The company has perfect equipments and plants and there are 5100 employees. The total asset is 23.6billion and net asset is 15.69billion last year. The production overhead of the company is currently absorbed by using a machine hour rate, as the indirect costs were not caused equally by all the products, this method became increasingly inaccurate. The cost accountants of the company decide to experiment by applying the principles of ABC to the two products currently made and sold by the company. Details of the two products and relevant information are given below for Jan 2008:

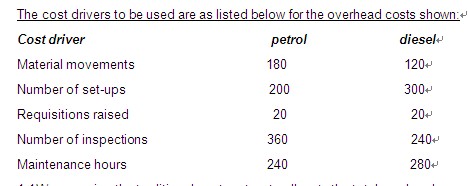

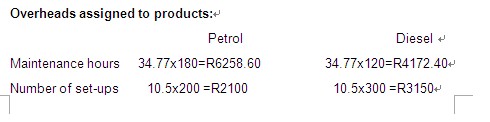

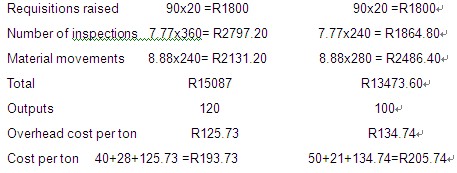

1.1 We are using the traditional cost system to allocate the total overhead. 1.2 ABC system Inspection and quality control cost per cost drive = R4660 / (360+240) =R7.77#p#分页标题#e# Overheads assigned to products:   1.3 The differences Cost per unit: Petrol is over-costed and diesel is under-costed with the traditional system. It is claimed that ABC system more accurately measures resources consumed by products. Where cost-plus pricing is used, the transfer to an ABC system will result in a different product prices. |