Case study :analyse the failure of OC company

时间:2010-08-09 10:27:00 来源:www.ukthesis.org 作者:英国论文网 点击:165次

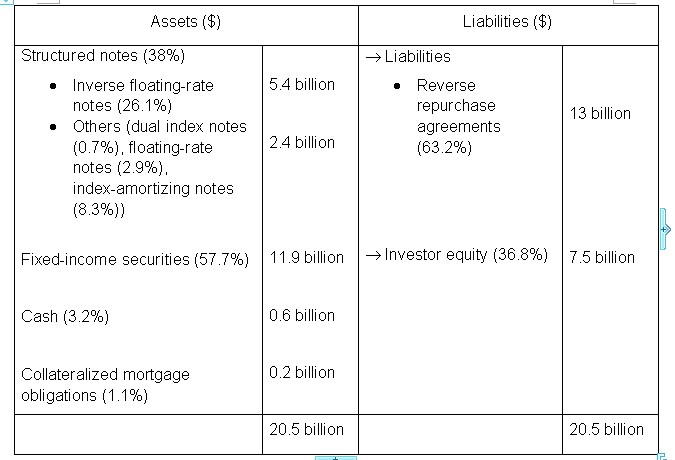

Case study questions: (Each question carries equal marks) In 1994, interest rates went up by about 3.5%. Compute the loss using the duration approximation and see how this compares with the actual loss of $1.64 billion. The Excel data file attached contains 5-year monthly yields from 1953 to 1994. Measure the volatility of the change in yields in December 1994 (use any simple measure of volatility). Compute the monthly portfolio VaR in December 1994 at the 5% cut off point, using the variance-covariance method. Use Excel to give a histogram of the monthly change in yield (using the whole data set). Using this distribution compute VaR using the Historical-Simulation method. Compare the VaR obtained using the two methods and discuss your findings. Convert each of the monthly VaR figures (from the above two methods) into an annual figure using the ‘root-T’ rule. What assumptions are you making when you use this ‘rule’? Are these assumptions realistic? Is your figure for the annual VaR consistent with the $1.64 billion loss? Compute a time-varying volatility of changes in yields using the EWMA model. Using the EWMA forecast, compute the monthly standard deviation for the six months before December 1994 and see if the actual change in interest rates is within or outside your EWMA forecasts. Would the use of the EWMA forecast for December 1994 have altered your view of the VaR, compared with your earlier attempts above? Backtest your EWMA model. Take the last 100 months and your EWMA forecasts to see if at the 5% left tail cut off level (for the normal distribution) there are more than 5 ‘outliers’. Discuss your findings.

|