英国纽卡斯尔大学(Newcastle University):中国老人退休现实和问题

时间:2013-06-24 13:40:28 来源:www.ukthesis.org 作者:英国论文网 点击:114次

Retirement reality and problems

The present generation of people over age 60th are all born before 1949, the founding of People’s Republic of China. They are normally poor and still have the traditional concept of pension, and be together with their children is the best choice. Some of these elderly are receiving pensions from government at the same time. Thus the majority of present old generation is actually having a not bad old age. Elderly who choose the third type are generally not very old and also have good health condition. Once they get even older, they cannot live alone anymore. In other words, the effective pensions are only first two types.

Elderly who living with their children could have a better care on both material and moral, but this status quo is not sustainable. There are two reasons.

First is traditional concept change of old age life. On the one hand, majority of the present young people are willing not to live with their children after retirement. On the other hand, they also do not want to over-rely on their children financially due to the baptism in the modern values. These people will have more consideration on how to establish its own pension plan and increase savings. In another words, they will be more biased with the first or third way of pensions.

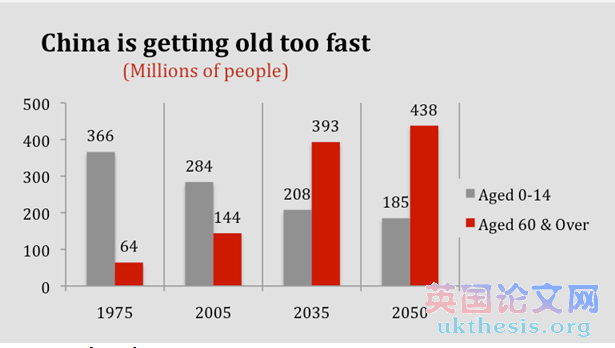

Second reason is much more important, which is aging population. Thirty-five years ago, the proportion of children population and elderly population was 6:1. However, after thirty-five years, this proportion will be inverted (Richard, 2004). The harsh winter of aging population is coming, and lead to the future of family structure will be like an inverted pyramid. When elderly people more than children, the informal family support network will be impossible to constantly maintain. Therefore, picture of the future left us only one choice, which is state pension insurance.#p#分页标题#e#

2.2 Aging population, low average income and poor pension coverage

Figure 2 – Demographic forecasting

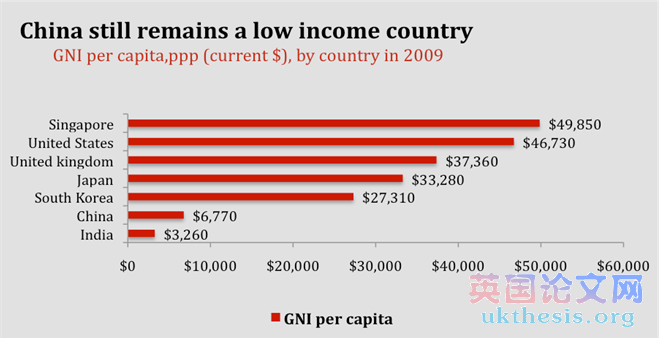

China gets old in one generation, while European countries used almost one hundred years. China’s labour force population will be reduced by 18%-35% around 2050. The “one-child” policy has controlled the population growth speed, but also controlled the birth rate. Plus longevity factor, China will become a white-haired country in 35 years. Most aging countries in the world were getting rich before getting old. If China cannot develop quicker than aging, after 35 years, China will face a very harsh situation, even a big social unrest. During the 30 years after Economic Opening, the average Gross Domestic Product (GDP) growth rate was 9.8 per cent in China, and 10.6 per cent in the past 5 years. Despite this long-term rapid economic growth, but up to now, it still cannot make up the negative effects of demographic explosion. In 2009, the Gross National Income (GNI) per capita in China was 6,770 dollars, while UK had 37,360 dollars and Singapore had 49,850 dollars. It was 7 times distance, which represent China is still a low-income country.

Figure 3 – Gross national income per capita in different countries

Until 2010, China’s Gini index has exceeded 0.5, which means a big gap between rich and poor. In other words, the existing GNI per capita is pulled in some by rich people, and majority of average Chinese should have lower income. However, the present state pension system has not yet considered about wealth gap. It is really not good for social harmony.#p#分页标题#e#

Since the economic reform from 80years, China has started a rapid urbanization construction. Large number of labour force into the first-tier cities, but construction of rural areas did not keep up with the same period, resulting in a huge income page between urban and rural areas. And because most of young labour force into urban from rural areas, the aging population is more serious in rural areas.

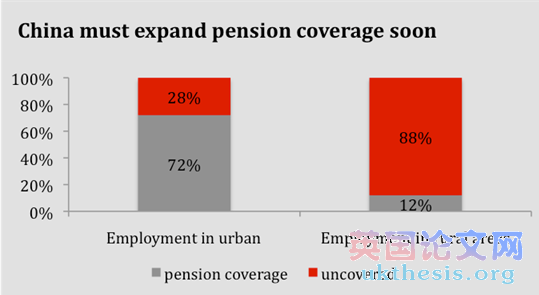

Figure 4: Large number of uncovered

The income difference between urban and rural also results in two lines of China’s pension system. By 2008, pension coverage in urban was 72 per cent, while only 12 per cent in rural areas. However urban labour force accounted for only 39 per cent of national labour force, and rural labour force accounted for 61 per cent. That is the whole pension coverage rate is only 35.5 per cent in China. There were 499 million working people who still do not have pension insurance at all. |