管理会计案例研究 Management Accounting Case Study

04-23, 2018

这是一个管理会计报告将更多地关注成本和预算。据介绍,成本法、信息分析、计算、理论和应用等黄金公司可以帮助读者对这一主题有清醒的认识。最大的组织成本问题也将在报告中提及。

此外,还有大量的信息,预计明年的成本和分析的信息,可以使读者在会计环境中的实际经验。

INTRODUCTION:简介

This is a report of management accounting will focus more on cost and budget. According to reports, the issue of cost method, information analysis, computation, theory and applications of gold companies that can help readers may clear understanding of this topic. The problem in making the cost of the largest organizations will also be mentioned in the report.

Moreover, there are many examples of information expected costs for the next year and analyze the information that can make the reader practical experience in accounting environment.

I. Identify and classify the different types of costs incurred in Wine Company

1. Cost classification

The cost classification is divided into three categories called cost classification for stock valuation and profit measurement, cost classification for decision making and classification for the control. According Vang Company, they have adopted the classification of expenses for stock valuation and profit measurement that can help them make the kind of cost-effective and also predict risk or revenue for their future. There have costs that are present in all organizations can help accountants can easily calculate the cost of an organization. Accordingly, the cost will be divided into direct material costs, direct labor costs and direct costs for each corresponding indirect. Moreover, the cost also refers to a number of other costs such as administration overhead, high on S & D, production costs and time costs. ( Case Study )

1.1 Direct costs

Direct costs means costs that are directly attributable to production of a product or service provider. A direct costs include direct material costs, direct labor costs and other direct costs ( financial accounting and management financial statements, p6, 2010 ) .

The first is the direct material costs. Direct material costs are the direct costs of materials used to make and sell products or provide services ( financial accounting and management financial statements, p7, 2010 ). At Vang Company, because this is a company specializing in producing custom t-shirts for corporate events, family and group, they should have sufficient material to produce t-shirts as fabric, sewing. So to have the documents, the company needs to pay for the provider.

Next is the direct labor costs. Direct labor costs are the specific costs of employees or workers directly used in the production of goods and services ( Ukessays, 2014 ). Direct labor costs include salaries, wages, allowances and deductions from wages as social insurance, health insurance. According to the law of Vietnam, workers minimum wage is 1,150,000 VND / month. At Vang Company, has 25 employees, including 21 in production and 4 in management and sales ( Vang Company Case Study, 2014 ). So Vang Company must pay their employees at least 1,150,000 VND / month and can pay more depending on the job level ( Wikipedia, 2013 ) .#p#分页标题#e#

Direct expenses are part of the direct costs that are spent in making a product or providing a particular service, or run a department ( financial accounting and management financial statements, p7, 2010 ). To ensure the quality of T - shirts, Vang Company using electric sewing machine to sew and hand silk screen printed. Using the device 's power costs incurred to produce T -shirts ( case studies vang Company, 2014 ). They are tools to be purchased or leased by Vang Corporation to make T -shirts .

1.2 Indirect costs :

Indirect costs or overhead costs include indirect costs that material, indirect salary costs, indirect costs, administration costs, S & D costs .

Indirect materials related to products, but not derived from the finished product. That the documents without material used as direct but it also helps to finished product. For example : A number of indirect materials in their wine companies are sewing machines, chemicals for cleaning cloth or machine, scissors, gloves protect workers when they work or some tools that can help to determine product .

Indirect salary costs for wages that but it is not related to the production process and to not participate in the product. For example : Vang Company also need to pay for the management, monitoring and help them search activities and enterprises but they do not work on the product line. The security and cleaner for Vang company also not working on product activity so that Vang company also have indirect wages for them.

Indirect costs which are not charged directly to production ( management accounting and financial statements, 2010). Vang companies also pay insurance for employees, their production and also pay rent for the old buildings that they rent for offices and factories .

The administration costs that the costs related to the management and operation of the company ( SmallBusiness, 2014 ). For example, Vang Company will pay the wages office concluded wages of secretaries, accountants and also they have to pay rent, rates, insurance, light, sanitation, telephone, portal, bank charges, legal costs .

The S & D costs, including marketing materials, advertising, packaging, salary and commission sales staff, rent, rate, insurance, cost of product delivery

Vang company. They also change the quality and packaging of individual products are wrapped in recycled brown paper bag

1.3: Fixed cost, step cost, variable cost and semi-variable costs:

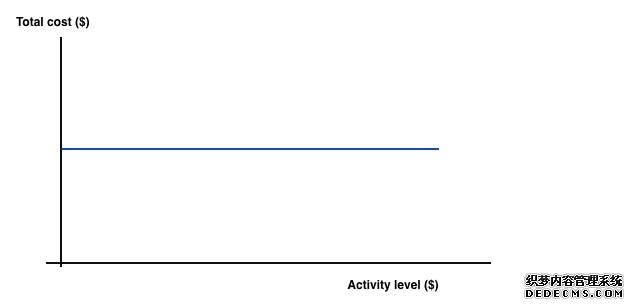

Fixed cost is a cost which remains constant within a certain level of output or sales is unaffected by changes in the level of activity (Finance management accounting and financial reporting, p11, 2010).

#p#分页标题#e#

Figure 1: Graph of fixed cost (Google, no date)

In Vang Company, the fixed cost could be salary of employees, the rent of factory building and equipment. However, in Vang company case study, fixed factory cost changed from 2006 to 2008. It increased from 20,000$ to 30,000$ in 3 years. This proves that the economy is not stable.

Step cost is fixed cost when paying company but costs have risen because of the increase of production volume or something it might be reduced because of reduced production volumes. The cost steps can occur due to the company's expansion. For example: For Vang company if they received more T-shirt from customers that they will make more t-shirts, and they need to have more staff will make them increase the cost or they need to hire to plant because the increase of the laborers.

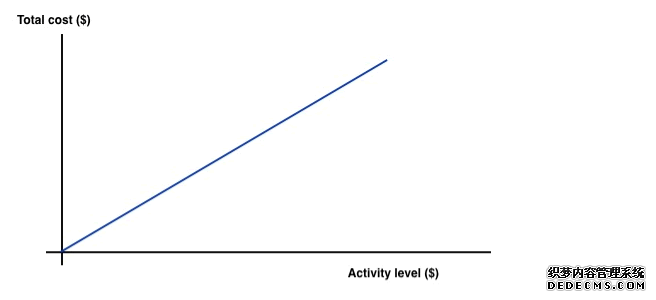

Variable cost is a cost of labor or material change with activity level (Rosemary Peavler, 2014). In Vang Company, variable costs include raw materials, packaging, and labor directly involved in the production process of the company. Variable cost plants raised from $ 70,000 to $ 120,000 in 3 years from 2006 to 2008 (Case Vang Company, 2014).

Figure 3: Graph of variable cost (Google, no date)

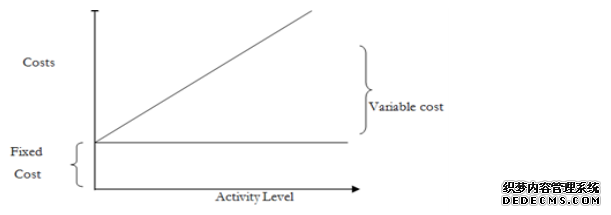

Semi-variable cost are the costs that contain fixed cost and variable cost components. For example: Vang company also need to pay salary (fixed cost) and commission (variable cost) for salesperson and it's a semi-variable cost.

Figure 5 : Semi-variable cost (google)